Ever wish you could check your credit score without having to sign-up for one of those scummy “free” credit check service that changes you $20-30/mo if you forget to cancel it?

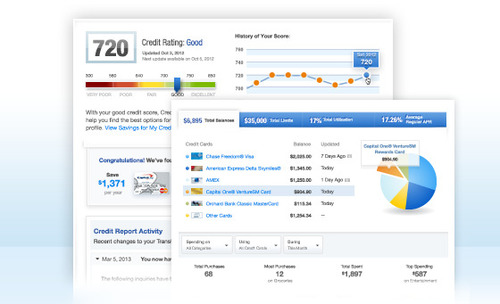

Credit Karma is what I use for this. It lets me check my FICO score every few months and tweak what I’m doing to keep my credit score nice and high. It also shows what factors go into computing my credit score I know how to improve it — without having to waste time memorizing details of the FICO formula. This is a nice lifehack if you want to a be offered a perpetual stream of high-limit, 0% promo credit cards… which, incidentally, pushes your credit score even higher over time.

It’s also helpful if you ever go apartment hunting. You can use it in conjunction with AnnualCreditReport.com to get both your credit score and your full credit reports for free. Not only does this save you the $20-50 credit check fees, but if you’re in a competitive housing market like New York or the Bay Area, showing up early to an open house with a completed application and a copy of your credit report + credit score is the best way to insure they rent to you instead of the 20 other applicants who show up for the most desirable housing in town.

6 Responses to “How to Monitor Your Credit Score”

February 22

Lev Shuhatovichif you’re thinking of buying a house, apply for a mortgage and when the big bank sales guy calls you, you will get a lot of useful information for free (at the cost of one credit pull). they will have all your credit info handy when they call you to sell you a product. just write it down 🙂

i recommend chase for that portion because their pre-approval comes in pdf in less than a day (which you will need to submit offers). bofa is slow.

on a related note, both lenders are expensive on closing and will sell your mortgage to a third party anyway, and I’ve discovered amegy is far more competitive on rates and they can help you close way faster.

February 22

Traci ParkerI use Credit Karma too!

February 22

Jim SpellmanDitto, plus http://www.annualcreditreport.com every four months (one for each credit bureau) since it’s the true, free one established by law.

February 22

Alexei AndreevJust signed up. Super painless and simple. Learned that part of the score is measured by how many lines of credit you have. You need 5+ just for D.

February 22

Willem BultI’ve been using this for a while, together with creditsesame.com, which does the same thing but pulls from Experian instead of TransUnion.

February 23

Michael KatsevmanBarclay credit cards display one of your FICO scores. I don’t remember which FICO credit karma displays.