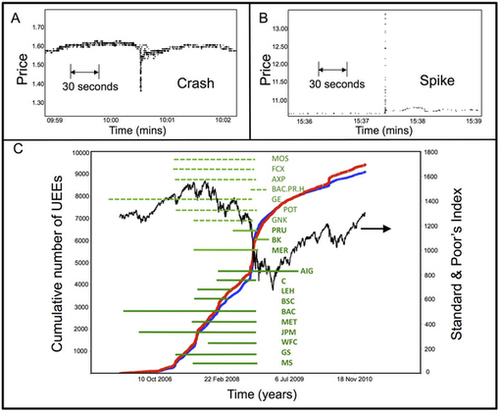

The 2008 financial collapse correlates exactly with a rapid acceleration of ultrafast extreme events (UEEs) in the market. During the crash, trading algorithms rapidly spiked and crashed stocks over 2000 times by a huge percentage of their total value in the course of only 25-1500 milliseconds.

It looks like the stock market itself (and not just the underlying value of companies traded on the market) has permanently lost value due to becoming irreparably and inherently unstable as HFT algorithms have driven market behavior times below human reaction times (by several orders of magnitude). The primary dynamic of financial markets is no longer trading based on company valuations or news, but trading within an ecosystem of bots engaging in mindless front-running and game-theoretic warfare.

As the researchers point out, “far from simply generating faster versions of existing behaviour, we show that this speed-up can generate a new behavioural regime as humans lose the ability to intervene in real time.”

9 Responses to “Abrupt rise of new machine ecology beyond human response time”

February 23

Alexei AndreevAdam Pumm, more data on machine trading actually causing damage.

February 23

Chris HallquistI’m skeptical that HFTs are particularly harmful. Wasn’t aware of this thing, but was aware of the flash crash, and as long as events like that are rare in the grand scheme of things, they don’t seem like much of a problem.

Maybe need a second layer of algorithms that try to detect such events, and if they think such an event might be happening right now, they delay any human-initiated trades being made in that instant by 5 seconds.

February 23

Louie HelmChris: HFT designers would love that kind of regulation. Front-running is precisely trying to know others’ trades in advance and manipulating the market to make extra money from the trade that someone else is about to do. 5 second delays would be goldmines and every trade done by a normal person would be manipulated (even more) to have the price rise right before they bought and the price drop right before they sold.

Have you ever executed your own trades on the stock market? This kind of behavior is extremely noticeable and has gotten much worse in the past 15 years. If you buy 100 shares of some stock personally, you will get heavily gouged on both sides of the spread.

February 23

Marius van VoordenCould this be avoided by executing trades in batches, every minute or so? Perhaps in randomized order.

February 23

Chris HallquistHmmm… okay, I may unqualified to have an opinion on this. Still seems implausible that very rare fluctuations that bounce back immediately would be a big problem. Any good explanations out there of why they would be?

February 23

Chris HallquistTwo questions: any evidence UEEs played a role in causing crash rather than being an epiphenomenon? And what is the evidence for the claims in the second paragraph you quote?

February 23

Gary BasinI would say I’m qualified to have an opinion, and no currently I don’t make money from being “super fast”. To address your points: A) Yes these “flash” error events have increased in frequency. So what? They are quickly corrected (the price comes back, no long term impact) and the only participants harmed are those using stop orders (no one should be using a stop order, ever, for any reason). B) From all data I’ve seen, implementation shortfall (standard measure of execution cost) has fallen monotonically over time, although it has flatlined the past few years as we’ve hit the limits of transaction costs (clearing, etc.). C) Please be careful when you label stuff as front-running. Front-running in the typical sense is a serious crime. It only applies to an agent who trades in front of a customer order that he has fiduciary duty over. HFTs (and really, it has nothing to do with HFT but rather being a sophisticated market player) will try to identify patterns using publicly available data in order to predict order flow which allows them to predict future orders, this is how traders have always made money (other than pure arbitrage, which is this exact same mechanism except with no time-lag or translation risk). D) If as a sophisticated participant you do not want to be exposed to increased execution costs of your large order due to detection by other market participants, you have to be smarter… That’s how capitalism works. E) As a non-sophisticated market participant, you really have no business trading in the first place. Even though HFT has made it cheaper (yes, it has, please show me evidence if you have any to the contrary) you still do not have a positive expectancy doing so unless you’re one of the tiny percentage of people that do this successfully full time and are independent ( I know a few and they struggle). F) Regarding batch auctions, no they will not reduce the impact of latency although if you go to really infrequent batch auctions I think there will be less money to be made since there will be less stupid trading by the buy-side (I’m talking like daily batch auctions). The financial industry will never let that happen though. There are reasons why HFT is “bad” but it is not for reasons most uninformed outsiders cite. HFT is bad for the same reason that the financial industry is bad, much of it exists to perpetuate itself and investors pay for it.

February 24

Louie HelmI guess I don’t see a material distinction between front-running on a client and the typical behavior of modern high speed traders of directly sniffing packets off fiber lines destined for the exchanges and inserting automated trades in front of opponents.

Reminds me a lot of the Rock-Paper-Scissors machine that wins 100% of the time by simply looking at your move first. http://www.youtube.com/watch?v=3nxjjztQKtY

February 24

Gary BasinWell define what you mean by sniffing packets off fiber lines. I’ve never heard of that being done and I agree that’s blatant abuse – might as well be hacking into their servers