I’ve traded stocks and options for years now. I’ve used E-Trade, TD Ameritrade, Scottrade, ShareBuilder, and Fidelity. But I can’t really recommend working with these companies anymore. Actively trading stocks and options has been profitable for me, but probably not more profitable than simpler strategies that wouldn’t have required as much time, attention, and emotional involvement.

1. Get A Simple, Automated, Investment Account @ Betterment or Wealthfront

As an economics student, my professors drilled into me that there’s one optimal portfolio to own – the market portfolio. I’m no smarter than the millions of other people watching the market, and I don’t have better information. -Jon Stein, CEO Betterment

There are several newer, low-cost companies that allow you to get automated exposure to the market without having to execute trades, pay fees, or manage anything. The main players (ordered by total assets managed) are Wealthfront, Betterment, Personal Capital, and FutureAdvisor.

Betterment and Wealthfront both have their advantages, but I’d recommend most people start out with Betterment for these 5 reasons:

- Betterment has no minimum deposit. Wealthfront requires $5,000 to open an account.

- Betterment has a simpler signup process. Both firms invest it in a well-balanced mix of low-fee index funds on your behalf. But Wealthfront grills you with a series of fairly complex investment questions in order to figure out your risk tolerance. I don’t think their system does any better than Betterment’s much shorter, simpler signup process which also determined the exact same risk profile for me with way less hassle.

- Betterment has tax-loss harvesting for accounts with as little as $50,000. Wealthfront requires investors have $100k+ before you get their tax-loss harvesting product. Especially if you’re not going to start out with that much, you probably want to be with the company where you can more quickly gain access to this extra 0.77%-1.6% in expected earnings.

- Betterment’s top tier fees are much lower (0.25% / yr) than Wealthfront’s. Wealthfront is technically cheaper for accounts with $5-$15k in them, but this initial savings is very small and only useful for people who can deposit a lot up front. If that’s you, there’s probably no downside to investing $5-$15k into a second account at Wealthfront.

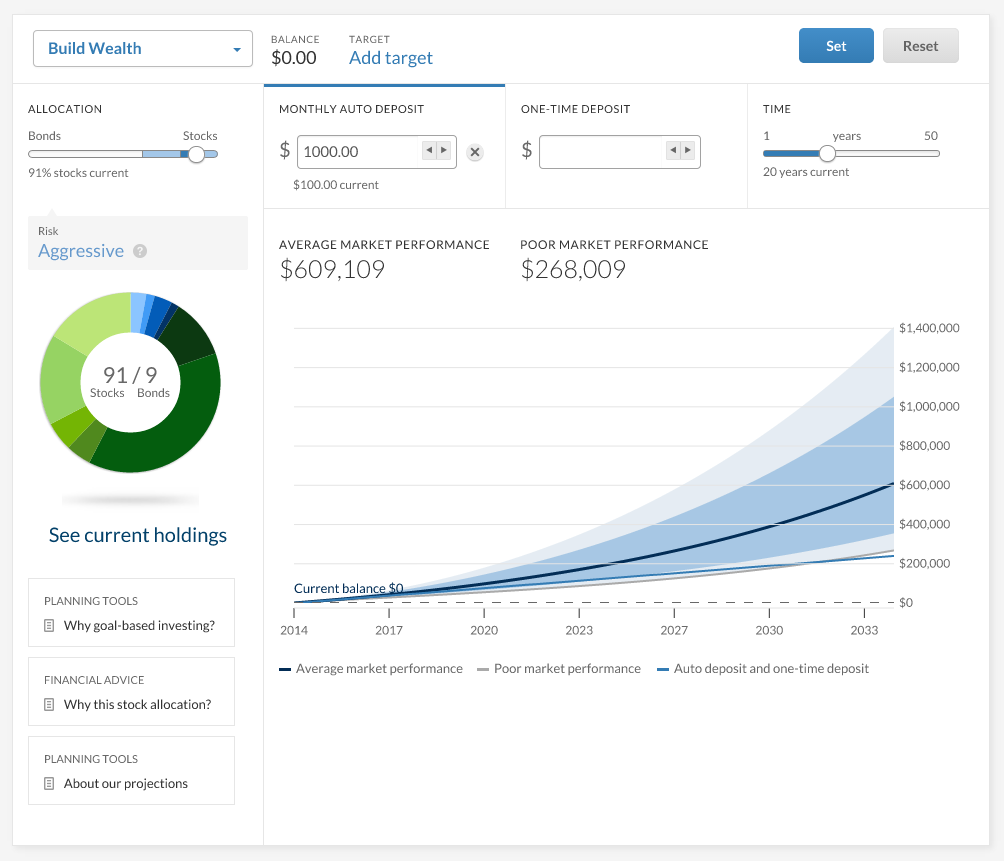

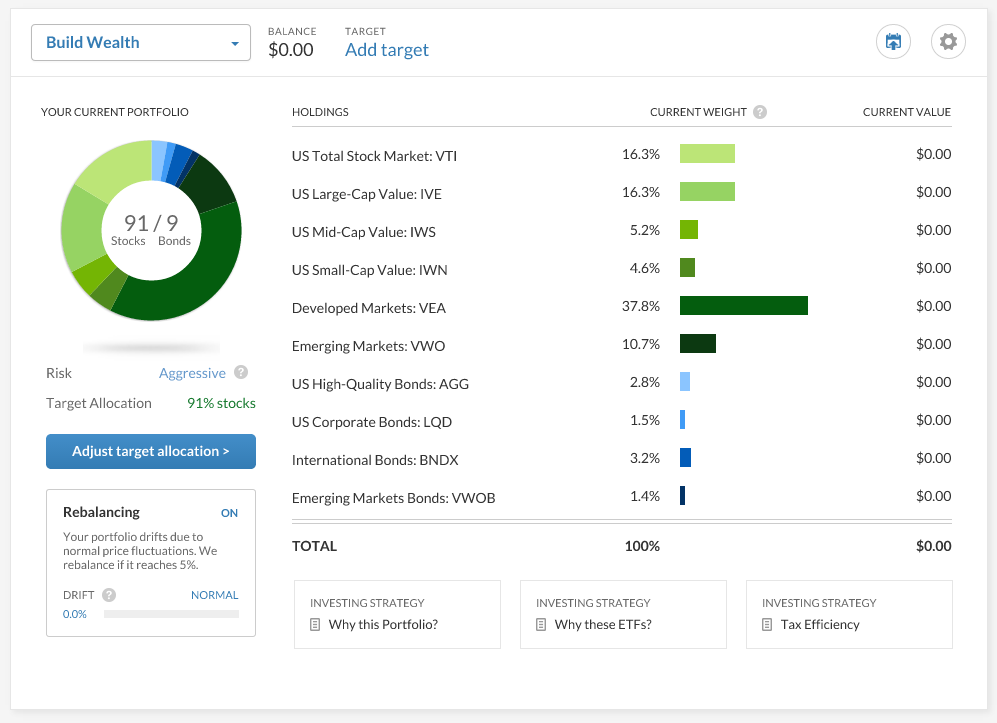

Once you have a Betterment account, you also get really well-designed dashboards like these:

2. Maybe Also Put Some Money Into Peer-to-Peer Lending @ LendingClub

Daniel Odio wrote a great introduction to LendingClub. The same reasons he’s investing is why I am:

I was at a VatorSplash startup event where I heard the CEO of LendingClub, a peer-to-peer investing platform, talking about his company’s growth. It was impressive. They’ve funded over $3.5 billion in loans (including over $250 million in the past month) and they’ve paid over $345 million out to investors in interest. Although there’s a lot of talk about the sharing economy generally (think AirBnb, Getaround, Lyft, etc.), LendingClub might just be the giant of them all: Sharing your hard earned dollars with those who need them, and are willing to compensate you for loaning them out.

The idea behind LendingClub is this: Banks return a paltry, sub 1% return in checking & savings accounts. But credit cards often have a 15%+ interest rate. There’s a huge spread there. If a lending platform could use technology to efficiently help investors get a higher return on their money than a bank’s offering, while letting borrowers get a lower interest rate (on, say, their credit card debt), then everybody wins. That’s exactly what they’ve done, and it’s awesome.

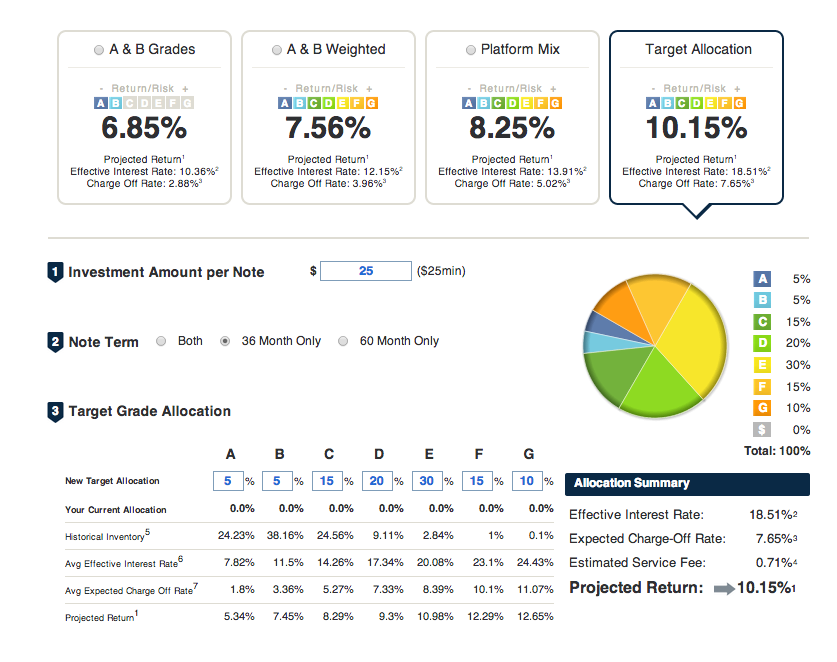

But it gets even better. LendingClub lets you customize the level of return you want to get based on the amount of risk you’re willing to take. Every borrower is scored between A1 (best) to G5 (worst). You can pick which types of loans you want to fund. The riskier borrowers will pay higher interest, but there will be more charge-offs. My wife and I created a fairly aggressive portfolio that is projecting a 10.15% annual return. Here’s a screenshot:

You can see that the effective interest rate predicted is 18.51% based on our chosen mix of A through G notes we’re funding, but 7.65% of that return is expected to be charged off, netting out to 10.15%.

The beauty of LendingClub is that your investment is divided into $25 chunks and is then diversified over hundreds or thousands of loans, which really mitigates your exposure. Think of it as your own personalized CDO 🙂 LendingClub also has a service called “PRIME” which will invest the money for you based on the risk & return profile you specify (that’s what the screenshot above is showing). The minimum investment amount for that service is $5k, and I recommend using it so you don’t have to try picking the loans you want to fund manually. But if you don’t want to put $5k into it, then you can get started with as little as $25, and it’s the same story as stocks — putting just a little money here is infinitely better than zero, if only to get you in the mindset of being an investor. Or conversely, if you have, say, $1MM to deploy and you’re willing to put it to work at the risk level we chose above to achieve a projected 10.15% return, you could potentially earn $101k a year in interest income; enough to basically not have to work (don’t forget about taxes, though; interest income is typically taxed at ordinary income rates, so cut 35%-ish off the top). You can learn more about peer-to-peer lending here.

Note: The minimum to invest with PRIME @ LendingClub recently dropped to $2,500.

For those who are curious, here’s how I would rank the financial services companies I’ve worked with:

- Online Advisors: Betterment > WealthFront >

Personal Capital>FutureAdvisor>BrightScope - Peer-to-peer Lending: LendingClub >

Prosper - Online Trading: Fidelity >

Scottrade>ETrade>TD Ameritrade>ShareBuilder - Online Asset Dashboards: Mint >

SigFig>Dough

36 Responses to “Betterment vs. Wealthfront vs. LendingClub”

June 23

Maxim Kesincc: Yuriy Goldman.

June 23

Austin James ParishThanks Louie for posting these informative guides about trading and investing. I’ve found them really useful and I appreciate it.

June 23

David McNettI switched from Fidelity to Personal Capital earlier this year. Too soon to judge returns, but I’ve been very happy with their site and the advice I’ve gotten. Even if you’re not interested in their management product, the free website seems much better than mint.com to me, with less focus on cash flow and budgeting and more focus on net worth and long term trends. I always found it difficult to really get a good long view from mint.com, which seems more focused on transactions than assets.

June 23

Joe JansenGreat review Louie. I’m also a big fan of the Betterment + LendingClub combo.

June 23

Marius van VoordenInteresting! Regarding LendingClub, if your chuck of money is diversified so widely, wouldn’t you always want to choose the risk tier that gets you the greatest average return?

(or is your 10.15% tier exactly that?)

June 23

Louie HelmWith LendingClub, the more your portfolio weightings deviate from their market mix, the longer it takes to pick up new loans in that class. Only matters if you have tons of money with them or have extreme weightings. Also, their yield estimates could easily break down. If you buy super low grade (high yield) loans, you could get slaughtered with charge-offs if the wider economy goes south.

June 23

Marius van VoordenMakes sense.

Are you confident their yield estimates are accurate in the economy right now?

June 23

Jeff AlstottBetterment invests in Vanguard products. Going with Vanguard directly results in lower fees. “Betterment adds fees on top of expense ratios, their fees do not replace expense ratios. Investing directly with vanguard will result in lower fees.” See more discussion here: http://www.reddit.com/r/personalfinance/comments/1xo40l/betterment_vs_vanguard/

June 23

Louie HelmTrue. But Betterment’s fees are really low. I think they’re worth it since they do a ton of work for people. Almost no one knows which Vanguard funds to buy, in which proportions, how to reduce trading fees, how to avoid getting hurt on both sides of the spread if you buy odds lots or fractional shares, remembering when and how to rebalance. I *could* do all that, but it’s a huge hassle, even when you know how. Most people really couldn’t sort out exactly how to weight, much less how to do the rest. And most people don’t have the time or expertise (much less volume) to do tax loss harvesting.

Even putting aside the fact that 99% of people would just procrastinate on learning the above rather than investing, I think it’s pretty nice to be able to just have them handle it all so you can ignore your account. Happiness research shows that people who watch the stock market more often are less happy. If you’re rebalancing 2-4 time per year and doing tax loss harvesting, you’ll have to keep a really close eye on the market.

June 23

David McNettPersonal Capital’s edge is that they use Pershing as the custodian for the accounts and they’ve worked out a fee-sharing partnership with Pershing to eliminate all trading fees. Customer assets bypass the funds and invest directly in securities/ETFs, eliminating fund maintenance fees. You pay a percentage of assets managed to Personal Capital, which they share with Pershing, and no other fees at all. They’ve also got a clever approach where all fees are paid from your taxable account, and none paid from tax sheltered accounts (like an IRA or Roth IRA), so that retirement funds are effectively 0% fees.

June 23

David McNettAnd I agree completely, Louie. These mechanical and algorithmically assisted advisor firms are a huge win for the vast majority of people who prefer not to actively manage their own investments. One important detail that should be considered is which companies are Registered Investment Advisors (with a legal obligation to act in the best interest of the client) and which are just securities brokers who aren’t bound by a fiduciary duty to act in your best interest.

June 23

Marius van VoordenTo answer my own question: Here’s a page with a lot of data regarding loans and ROI for both LendingClub and Prosper: http://lendstats.com/

June 23

Peter LaiA lot of new asset management programs do that now – they charge you a global asset management fee (of 1-2% of your total managed assets) and waive all trading fees and trade directly on the market to bypass individual fund management fees. (Chase has a similar program called the personally-managed funds). It’s basically like having your own mutual fund. The catch is you’re completely at the analytical mercy of your management team, and the question is: are they going to be better than the big houses with lots of market cap (Vanguard, etc.)? Sometimes if you don’t have enough net worth these programs can’t buy enough slices of securities and therefore dump your stuff into existing funds, which then erases all of the management fee advantage, so you have to watch out for that too (usually before entering into a management contract with them they will give you the tentative market strategy). Finally, you have to consider any opportunity and any tax costs whenever you switch management programs since it requires the liquidation of at least a portion of your existing holdings in order to buy the new ones that line up with the new manager’s strategy.

June 23

David McNettYeah, I did take a huge tax hit in the move to Personal Capital. That’s definitely something to consider.

June 23

Sean O HEigeartaighDoes anyone have a recommendation for a similar company that UK people can invest with?

June 23

Jonathan FisherCan anyone compare the above to Schwab (what I have through work)?

June 23

JollyI’ve been using lending club for a few years, I’ve put about 10k through with a real rate of return as “4.94%” (from LC’s dashboard). Also, Yodlee is still a better dashboard than the others, mostly becase it integratesw ith a wider range of financial services.

June 23

Marius van VoordenRight, Lending Club isn’t available for non US residents. Too bad, it seemed like a pretty good plan.

There are a few European equivalents, but none as large as Lending Club.

June 23

Louie HelmAlso, Fidelity supposedly offers something Betterment-like in some parts of Europe. I don’t know anything about it though: https://www.fidelity.de/de/fonds/sam/default.page

June 23

Marius van VoordenI’m currently looking into Bondera (formerly IsePankur), based in Estonia. It allows lenders from most countries in Europe, and they seem to have really good returns. Their lending system is a bit weird though, with having to wait in line to bid. Not sure of the details yet, but it seems that it makes it hard to actually lend out money, while at the same time keeping interest rates very high (>25%).

https://www.bondora.ee/en/invest/statistics/investment-returns

June 23

Louie HelmNo affiliation other than recently becoming a customer so I could review them.

June 23

Louie HelmI’ve also heard of Zopa for P2P lending in Europe.

June 23

Marius van VoordenZopa seems to be restricted to the UK, plus their US branch and Italy branch, as far as I can tell.

June 23

Alex KawasLouie, could you speak to each of these companies’ minimum exposure periods and any early withdrawal fees?

June 23

Louie HelmI know Betterment lets you withdraw without fees. I believe Wealthfront does too. You own the ETFs they’re buying for you. If you want to dispose of them, they will do it without waiting. I don’t think it’s like a mutual fund where there are sometimes minimum periods you have to hold things. You should double check though.

June 23

Jeff AlstottI agree that many people are not attentive/persistent enough to “manage” their own investments. However, if you’re even *modestly* attentive/persistent, it doesn’t require hardly any managing. Here is an example:

Every month Vanguard automatically deducts some money from my checking account. Vanguard trading fees are free, if you’re buying/selling Vanguard products (which are low fee and great). At this point I could have a standing order for a certain quantity of a particular product. If you’re doing just one product, the Total World Stock fund would be the investment of choice (VTWSX, or VT as an ETF):

https://personal.vanguard.com/us/funds/snapshot?FundId=3141&FundIntExt=INT

Vanguard automatically does all the rebalancing, etc. etc. There is literally nothing left to do. And they’re very cheap, at 0.3% for the mutual fund or 0.18% for the ETF. BOOM. You’re done.

For me, to drive down the expense ratio further, I do something slightly more sophisticated: I manually purchase the US stock market ETF (0.05% expense ratio, VTI) and the ex-US stock market ETF (0.15%, VEU), which I mix at a 50% ratio. Doing that yields a 0.1% expense ratio (compared to the 0.18% of the Total World ETF offered by Vanguard). Thus, I touch my investments by hand once per month: I calculate how many shares of VEU and VTI I need to buy to maintain an approximately 50/50 split between them. Then I buy and walk away.

I personally like the check in once a month to see how the global market is doing. But if I could automate that one step, I definitely would. I wish Vanguard did it slightly cheaper.

June 23

Gordon HelmNot as good as a Louie.

June 24

Nick Pisarrovanguard and its equivalents have effectively automated rebalancing products, e.g. target retirement funds in vanguard’s case https://investor.vanguard.com/mutual-funds/target-retirement/#/ . It does not have tax-optimized allocation products or tax loss harvesting. I wish vanguard had an API so you could automate these things yourself

June 24

Jake Nebelthis is awesome. “Get Notifications.”

June 24

Marius van VoordenIn an unexpected twist, it seems Lending Club might be open to foreign investors if you have enough money to invest. They mailed me to ask for a phone number to discuss options.

June 24

iheartWallStreetYou should probably disclose that you’re an affiliate for Wealthfront and Betterment, and you benefit economically.

June 27

Marius van VoordenLending club itself has a pretty reasonable statistics page. https://www.lendingclub.com/info/statistics-performance.action

Trying to determine the effective ROI over a longer period of time from that, it seems that on average an investor can expect a return of 6.9%, or up to roughly 8% if they only take high interest loans.

Based on portfolio age 24-30 months, 100 notes minimum, any portfolio concentration the following weighted interest rates give the following adjusted net annualized return:

18+% 8.8%

15-18% 7.9%

12-15% 7.0%

9-12% 6.2%

0-9% 5.2%

Louie, based on this, your expected return would seem overconfident. Do you have specific reasons why you would estimate a higher return than historical values?

June 27

Marius van VoordenA part of the discrepancy may be explaind by the Net Annualized Return calculation including loans starting at 3 months old. If most of the defaults happen later, the number you get out of that is higher than your actual expected return.

June 27

Louie HelmPart of the way you get higher returns w/ Lending club is by accepting only the shorter-term notes. It’s possible that the returns in Odio’s image are out of date too. I’m seeing lower calculated returns on LendingClub when making identically constructed automated portfolios as the one from the image.

June 27

Marius van VoordenThe longer term notes come with a higher interest rate, and assuming you reinvest your profits, naively you’d expect them to get you more profit. Are you saying the shorter term notes have a much smaller chance of default per year?

November 15

JakeWhy not put your money in an ETF for Biotechnology stocks? Such as BIB.

They have killed it in the past decades….